When you’re exploring home improvement loans, it’s crucial to compare secured and unsecured options. Secured loans, which use your home as collateral, typically offer lower interest rates and higher borrowing limits, making them suitable for larger projects. However, they carry the risk of losing your home if you default. In contrast, unsecured loans don’t require collateral but generally come with higher interest rates and lower loan amounts. This makes monthly payments steeper and could strain your finances. Understanding these differences helps you make informed decisions when financing your home improvements, leading to more effective planning and budgeting for your projects.

Overview of Home Improvement Loans

Home improvement loans provide homeowners with the necessary funds to renovate or upgrade their properties. These financing options can considerably boost your home’s value and comfort.

You’ll find home improvement loans offered as either secured or unsecured loans. Secured loans use your home as collateral, which typically results in lower interest rates and higher loan amounts, often exceeding $100,000. On the other hand, unsecured loans don’t require collateral, but they usually come with higher interest rates and shorter repayment terms, often capping around $50,000.

Your credit score plays an important role in determining your eligibility and the terms of these loans. Lenders often have stricter criteria for unsecured loans, making it vital to maintain a good credit score.

Additionally, interest payments on unsecured loans aren’t tax-deductible, while secured loans may offer tax advantages depending on their structure. Home equity lines are another option to reflect upon, allowing you to borrow against your home’s value.

Secured Loans Explained

When you consider secured loans, it’s important to understand the different types available and the benefits they offer.

These loans often come with lower interest rates and larger amounts, making them appealing for major home improvement projects.

However, it’s essential to recognize the risks involved, including the potential loss of your collateral if you can’t keep up with payments.

Types of Secured Loans

Exploring secured loans for home improvement reveals several options that can help you tap into your property’s equity. One common type is a home equity loan, which allows you to borrow against your home value. These loans often offer lower interest rates, typically between 6% to 10%, making them a financially attractive option for funding home improvement projects.

If you need flexibility, a home equity line of credit (HELOC) might suit your needs. This type of secured loan gives you access to a revolving credit line, allowing you to withdraw funds as needed.

Construction loans are another option specifically designed for major renovations or new builds. These secured loans provide higher loan amounts, often ranging from $10,000 to $250,000, depending on the equity in your home.

Because they use your home as collateral, secured loans generally come with longer repayment terms, spanning from 5 to 30 years. However, it’s imperative to remember that defaulting on a secured loan can lead to losing your home, which adds a layer of risk not associated with unsecured loans.

Each option has its unique features, so weighing your needs carefully is essential.

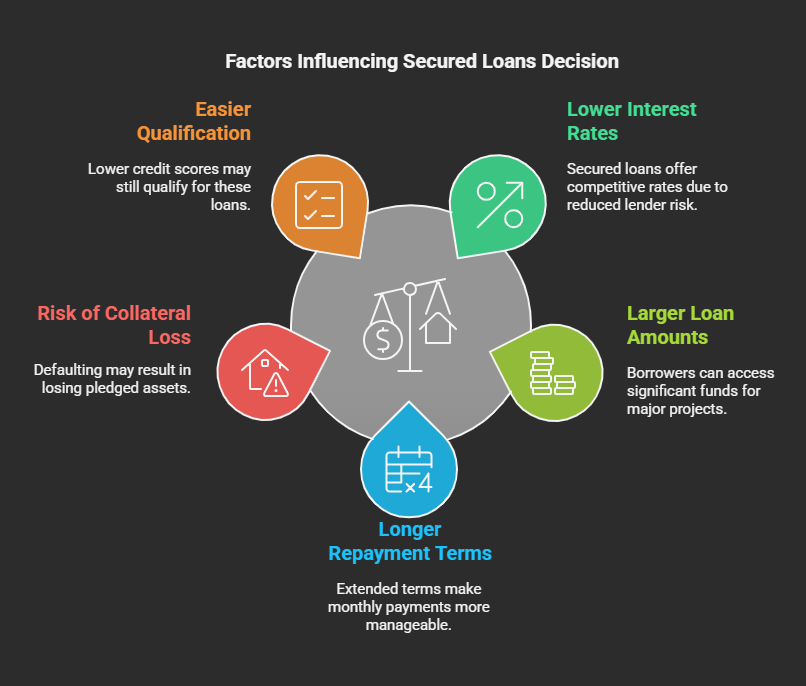

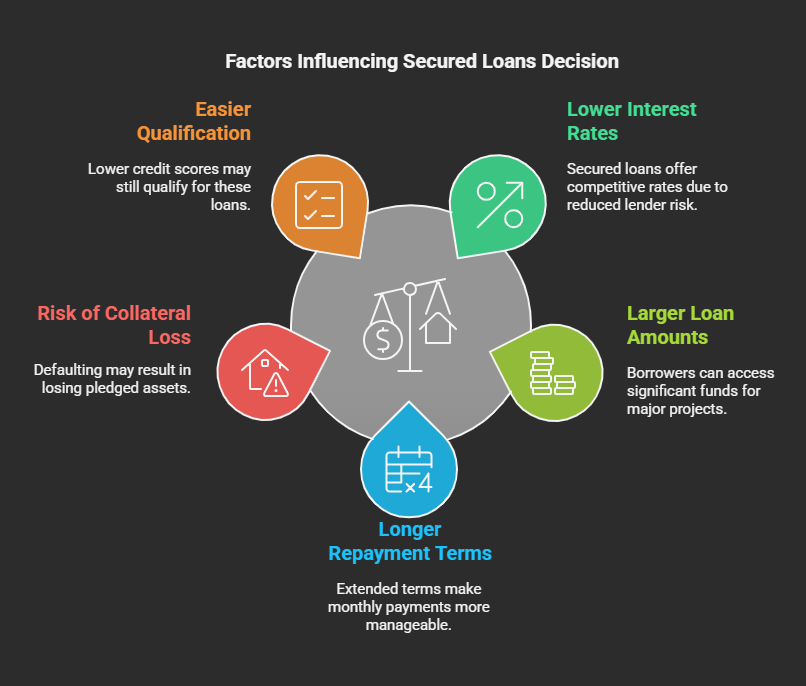

Benefits of Secured Loans

Secured loans offer several advantages that make them an appealing choice for financing home improvement projects. One of the most significant benefits is the lower interest rates associated with secured loans, which occur because you provide collateral, reducing the lender’s risk. This means you can save money over the life of the loan.

In addition, secured loans allow you to access larger loan amounts, often ranging from $1,000 to $250,000, making them suitable for extensive renovations or upgrades to your home.

Another advantage is the predictable monthly payments that secured loans provide, typically featuring fixed repayment terms spanning two to seven years. This consistency helps you budget effectively.

Moreover, if your credit score isn’t perfect, you might still qualify for a secured loan because the collateral increases your approval chances. However, it’s important to remember that missed payments can lead to asset seizure, so responsible borrowing and repayment are essential.

Risks of Secured Loans

Taking on a secured loan can feel like walking a tightrope for many borrowers. Secured loans require collateral, typically your home, which means that if you fail to repay the loan, the lender can take your asset. This aspect considerably increases the risk for borrowers.

While it’s true that secured loans generally come with lower rates than unsecured loans, the stakes are high. If you default on the loan, you could face asset seizure, leading to the loss of your valuable property.

The repayment terms for secured loans often range from two to seven years, requiring you to evaluate your financial stability carefully. If you have a low credit score, you might qualify for a secured loan more easily; however, missed payments can greatly impact your credit and lead to potential asset loss.

Though interest rates are typically lower due to reduced risk for lenders, the risk remains high for you as a borrower. Defaulting on a secured loan can result in more than just financial strain; it can jeopardize your home, making it essential to verify you can meet the repayment terms before proceeding.

Unsecured Loans Explained

When it comes to financing home improvements, unsecured loans offer a flexible option that doesn’t require collateral. Instead of leveraging your property, lenders assess your creditworthiness, income, and debt-to-income ratio. This means your ability to repay the loan is evaluated based on your financial history rather than the value of your home.

Unsecured personal loans typically range from $5,000 to $50,000, though some lenders may offer amounts up to $100,000. However, these limits are generally lower than what you might see with secured loans. Interest rates on unsecured loans can vary widely, usually falling between 6% and 36%, with an average exceeding 12%. This variation can lead to higher overall costs compared to secured loans.

Repayment terms for unsecured loans are often shorter, ranging from 2 to 12 years. This can result in higher monthly payments, potentially putting a strain on your finances.

Additionally, keep in mind that interest paid on unsecured loans isn’t tax-deductible, unlike certain secured loans. Ultimately, understanding these factors is essential as you decide between secured or unsecured home improvement loans.

.

Pros and Cons of Secured Loans

Weighing the pros and cons of secured loans reveals an appealing option for financing home improvements. One major advantage is the lower interest rates typically offered, which range from 4% to 8%. This is because secured loans are backed by collateral, reducing lender risk.

Additionally, borrowers can access larger loan amounts, often up to $250,000, making these loans suitable for significant home improvement projects. The longer repayment terms, spanning from 5 to 30 years, allow for more manageable monthly payments, further enhancing their attractiveness.

However, there are notable drawbacks to evaluate. The primary concern with secured loans is the risk of losing your collateral, such as your home, if you default on the loan. This can create significant anxiety for some borrowers.

While secured loans can be easier to qualify for, especially for those with lower credit scores, it’s crucial to assess the potential risks against the benefits. Ultimately, understanding the implications of secured loans will help you make an informed decision about financing your home improvements.

Make sure you’re comfortable with the risks involved before proceeding with this option.

Pros and Cons of Unsecured Loans

When considering unsecured loans for home improvement, it’s crucial to understand their drawbacks.

These loans often come with higher interest rates, which can greatly increase your overall costs, and they usually have lower borrowing limits that mightn’t cover extensive projects.

Additionally, the shorter repayment terms can lead to higher monthly payments, putting extra pressure on your budget.

High Interest Rates

High interest rates are a significant drawback of unsecured home improvement loans, making them a costly option for many borrowers. These loans often carry rates ranging from 6% to 36%, with averages exceeding 12%. If you have poor credit, you might face even higher rates, which can drastically increase the total cost of borrowing.

For instance, a $15,000 loan at 20% interest can lead to nearly $8,845 in interest payments over its lifespan. The lack of collateral in unsecured loans is a key reason for these high interest rates, as lenders perceive greater risk. This situation can strain your monthly budget due to higher payment obligations.

Additionally, interest payments on unsecured loans aren’t tax-deductible, unlike some secured loans, which further raises the overall expense of funding your home improvements. With repayment terms typically ranging from 5 to 10 years, you may encounter higher monthly payments, which can jeopardize your financial stability.

Before choosing an unsecured loan, it’s crucial to carefully consider these factors and how they may impact your long-term financial health.

Limited Loan Amounts

Unsecured home improvement loans often come with limited loan amounts, which can be a significant drawback for homeowners planning extensive renovations. These loans typically have a maximum loan cap of around $50,000, rarely exceeding $100,000. If you’re looking to tackle a large project, this mightn’t cover all your costs, as unsecured loans offer lower borrowing power compared to secured loans that leverage home equity for larger sums.

Additionally, unsecured loans generally feature shorter repayment terms of 2 to 12 years. This can lead to higher monthly payments, which may strain your financial budgets.

As you consider your options, remember that the higher interest rates on unsecured loans—ranging from 6% to 36%—can increase your overall borrowing expenses.

Before committing to an unsecured home improvement loan, it’s essential to assess whether the limited loan amounts align with your renovation goals. If you need a substantial sum, a secured loan might be more appropriate, even though it requires using your home as collateral.

In the end, evaluating your financial situation and project needs will help you make the best choice for your home improvement plans.

Alternatives to Home Improvement Loans

Finding the right financing for your home improvement projects can feel overwhelming, but you’ve got several alternatives to traditional home improvement loans.

One popular option is a home equity loan or a Home Equity Line of Credit (HELOC), which leverages your existing home equity. These typically offer a lower rate and longer repayment terms than many types of unsecured loans.

If your project is extensive, consider construction loans that provide funding based on project costs. This can be useful for significant renovations.

Another option is the FHA 203k loan, which combines the costs of purchasing a home and renovating it into a single mortgage, simplifying financing for home improvements.

Cash-out refinancing is also worth exploring; it allows you to refinance your existing mortgage for a larger amount than you owe, giving you access to cash for renovations while often securing a lower interest rate than unsecured loans.

Additionally, credit unions may provide competitive financing options, so check with them to see if they can improve your chances of securing favorable terms.

Exploring these alternatives can help you find the right fit for your home improvement needs.

Financial Considerations for Borrowing

When it comes to borrowing for home improvements, understanding your financial options is essential. You’ll face two main types of loans: secured and unsecured.

Secured loans typically offer lower interest rates, ranging from 6% to 10%, compared to unsecured loans, which can exceed 15% and average over 12%. While secured loans allow you to borrow against your home equity, often up to $250,000, unsecured loans usually cap at around $50,000.

Consider the loan terms as well; secured loans generally provide longer repayment periods, from 5 to 30 years, leading to lower monthly payments. In contrast, unsecured loans have shorter terms, typically between 2 to 12 years, resulting in higher monthly burdens.

Another important factor is your credit score. A strong score (670 or higher) helps secure favorable terms, while poor credit can lead to higher interest rates and lower borrowing limits.

Also, remember that while interest payments on unsecured loans aren’t tax-deductible, certain secured loans might qualify for tax deductions, depending on how you use the funds.

Read also: Types of student loans

Conclusion

To sum up, choosing between secured and unsecured loans for home improvement depends on your financial situation and comfort level with risk. Secured loans typically offer lower interest rates but require collateral, while unsecured loans provide flexibility without risking your assets. Carefully weigh the pros and cons of each option, considering your budget and repayment capabilities. Additionally, exploring alternatives can help you find the best solution for funding your home improvement projects while maintaining financial stability.

Finance News 365 is an online platform dedicated to providing individuals and businesses with comprehensive financial insights, market trends, and resources to make informed decisions.