Why Choose Travel Rewards Credit Cards?

You can elevate your travel experiences with rewards credit cards, but are you maximizing their full potential? Discover how to unlock incredible benefits.

Using secured credit cards is a practical method to build your credit history. These cards require a cash deposit that acts as collateral, making them easier to obtain for those with limited or poor credit histories. By using a secured card responsibly—such as making on-time payments and maintaining a low credit utilization—you can greatly improve your credit score. A higher credit score enhances your chances for future credit approvals and better loan terms. While secured cards may have higher interest rates, their primary purpose is to help you establish a positive credit track record. There’s much more to explore on this topic.

Understanding secured credit cards is essential for anyone looking to build or rebuild their credit. A secured credit card is a type of credit card that requires a cash deposit as collateral. This deposit not only serves as a security measure for the lender but also determines your credit limit. For example, if you deposit $500, your credit limit will typically be $500. This arrangement is beneficial for individuals with limited or poor credit history, as it allows them to access credit while minimizing the lender’s risk.

Secured card features include the ability to make purchases just like a regular credit card, and you’ll receive a monthly statement that helps you track your spending. By using the card responsibly—making timely payments and keeping your balance low—you can positively impact your credit score over time.

Additionally, many issuers report your payment history to the major credit bureaus, which is vital for building credit. Remember, while secured credit cards can be a stepping stone toward better credit, it’s important to choose one with favorable terms and low fees to maximize your benefits.

Secured credit cards and unsecured cards serve different purposes and come with distinct features that cater to varied financial needs. A secured card typically requires a cash deposit, which acts as collateral for your credit limit. This deposit often determines your credit limit, making it an important factor in your spending power.

In contrast, unsecured cards don’t require a deposit, and your credit limit is based on your creditworthiness.

When it comes to approval odds, secured cards generally offer better chances for individuals with limited or poor credit histories. Many issuers have more lenient policies for secured cards, recognizing that the deposit reduces their risk.

Additionally, secured cards may have higher interest rates than some unsecured options, so it’s vital to take into account your credit utilization.

While both card types come with varying account features, secured cards might offer fewer perks, focusing instead on helping you build credit.

Understanding these differences can help you choose the right card for your financial situation, ensuring you make informed decisions as you work toward improving your credit profile.

Building a solid credit history opens up a world of financial opportunities. When you consistently manage credit responsibly, you pave the way for credit score improvement. A higher credit score can lead to lower interest rates on loans, making it more affordable to borrow money for significant purchases like a car or a home.

It also increases your chances of being approved for credit cards and loans, which can further enhance your financial flexibility. Establishing a positive credit history demonstrates financial responsibility. Lenders view this as a sign that you can manage debt effectively, making you a more attractive candidate for loans.

This can be particularly important if you’re planning to make large purchases in the future or if you want to rent an apartment, as many landlords check credit histories during the application process. Additionally, a good credit history can help you secure better insurance rates and even impact your employment opportunities.

Many employers conduct background checks that include credit history, so showcasing your financial responsibility can provide an edge in job applications. Overall, building your credit history is essential for laying a strong foundation for your financial future.

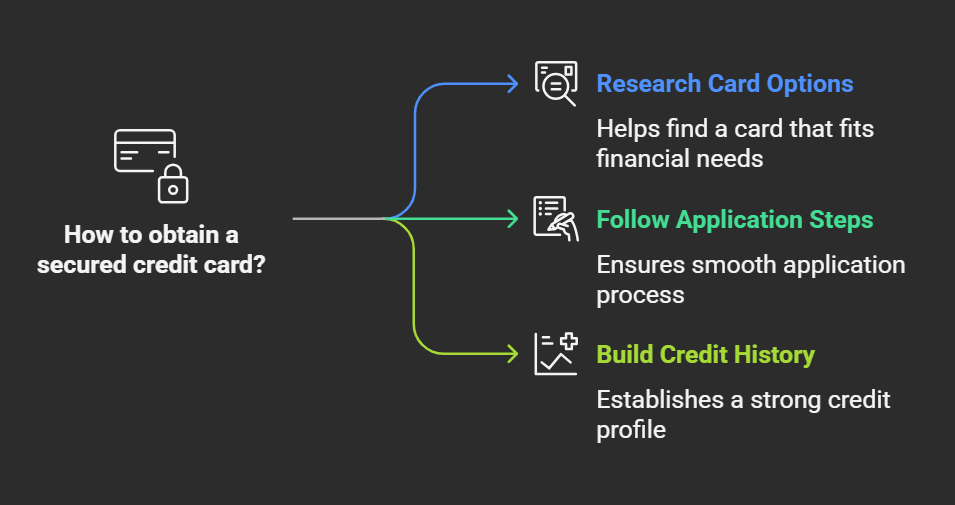

To obtain a secured credit card, start by researching various card options that fit your financial needs.

Once you’ve narrowed down your choices, you’ll need to follow specific application steps, which typically include providing personal information and a security deposit.

Understanding these steps will help you navigate the process smoothly and set you up for building a strong credit history.

When you’re ready to improve your credit score, researching card options is an essential step in obtaining a secured credit card. Start by identifying your financial needs and preferences. Different secured credit cards come with various card features, such as rewards programs, cash-back offers, or the ability to upgrade to an unsecured card later.

Assess what features matter most to you, as these can greatly influence your experience.

Next, compare interest rates among different secured cards. Lower interest rates can save you money if you carry a balance, while higher rates mightn’t be as beneficial for your financial situation. Additionally, consider any annual fees associated with the cards, as these can add up over time.

Don’t forget to read reviews and customer feedback to gain insights into the card issuer’s reliability and customer service. Look for cards that report to all three major credit bureaus, as this can enhance your credit-building efforts.

Read Also: Credit Card Types for Beginners

Typically, the application process for a secured credit card involves several straightforward steps that can help you get started on your credit-building journey.

First, you’ll want to choose a card that fits your needs, keeping an eye on the application requirements set by the issuer. These requirements often include providing personal information, such as your Social Security number, income, and employment details.

Once you’ve selected a card, you’ll need to submit your application, which may be done online or in person. Make sure you have all necessary documentation ready to expedite the process.

After approval, you’ll be required to make a security deposit, which acts as collateral and typically determines your credit limits. The deposit usually ranges from a few hundred to a few thousand dollars, depending on the card issuer’s policies.

After you make the deposit, your secured credit card will be issued, and you can start using it responsibly to build your credit.

Remember to make timely payments and keep your credit utilization low to maximize the benefits of this credit-building tool.

Managing a secured credit card responsibly is crucial for building a solid credit history. To achieve this, you should focus on two key factors: payment history and credit utilization.

Payment history accounts for a significant portion of your credit score, so it’s essential to make your payments on time each month. Setting up automatic payments can help guarantee you never miss a due date, which can positively influence your credit profile.

Additionally, keep an eye on your credit utilization rate, which is the percentage of your available credit that you’re using. Aim to use no more than 30% of your secured card’s limit.

For instance, if your limit is $500, try to keep your balance below $150. By managing your utilization wisely, you demonstrate responsible credit behavior, which lenders look for.

Your responsible use of a secured credit card directly impacts your credit score. When you consistently make on-time payments, it not only helps establish a positive payment history but also demonstrates your reliability as a borrower.

Lenders pay close attention to your payment history, as it accounts for a significant portion of your credit score. Missing payments can have a negative effect, so staying organized with due dates is essential.

Additionally, managing your credit utilization—the amount of credit you’re using compared to your total credit limit—is equally important. Ideally, you should keep your credit utilization below 30%.

This means if your secured card has a limit of $500, try to maintain a balance under $150. Keeping your utilization low signals to creditors that you can responsibly manage debt, further enhancing your credit score.

When considering secured credit cards, you might think they’ve limited usage opportunities and come with high fees.

However, it’s important to understand that secured cards can be used just like regular credit cards for purchases, and while some may have fees, many options are available with reasonable costs.

Clearing up these misconceptions can help you make an informed decision about using secured credit cards to build your credit.

Debunking the myth that secured credit cards offer limited usage opportunities can empower you to make informed financial decisions. Many people believe that secured cards are only accepted at a few places, which simply isn’t true.

In reality, secured credit cards are widely accepted wherever traditional credit cards are used. This means you can use them for everyday purchases, online shopping, and even recurring bills.

Another common misconception is that using a secured card won’t positively impact your credit utilization. However, responsible usage and timely payments can greatly improve your credit score. By keeping your credit utilization ratio low—ideally under 30%—you can reap the benefits of building credit while enjoying the flexibility of a secured card.

While secured cards may require a cash deposit as collateral, they function similarly to unsecured cards. You can make purchases, earn rewards, and build a positive credit history.

Many potential cardholders worry that secured credit cards come with high fees that could outweigh their benefits. While it’s true some secured cards have annual fees, it’s important to differentiate between necessary costs and hidden costs. High fees can be misleading when you consider the overall value of improving your credit score. Many secured credit cards offer minimal fees compared to the potential rewards of building a positive credit history.

You should also be aware that not all secured credit cards charge the same fees. Some may have lower annual fees or even waive them entirely if you meet certain conditions, such as making timely payments. Additionally, the deposit you make to secure the card often serves as your credit limit, which means your initial outlay mightn’t be as high as it seems.

It’s vital to read the fine print to fully understand any potential hidden costs, such as transaction fees or interest rates on balances. By doing your research, you can find a secured credit card that aligns with your financial goals, allowing you to build credit without getting bogged down by excessive fees.

If you’re looking to build your credit but aren’t keen on secured credit cards, several viable alternatives can help you achieve your goal.

Credit unions often offer credit-building loans, which allow you to borrow a small amount and repay it over time, helping improve your credit score.

Alternatively, you can explore prepaid cards; while they don’t directly build credit, some companies report your payment history to credit bureaus, providing a potential path to building credit indirectly.

Student cards are another option, particularly designed for young adults starting their credit journey. These cards typically have lower credit limits and fewer fees, making them accessible.

You might also consider becoming an authorized user on someone else’s credit card. This way, you can benefit from their positive payment history without being responsible for the debt.

If you prefer debit options, some fintech solutions are emerging that allow you to link your debit account to credit-building features.

Finally, reporting your rental history can also be beneficial; some services will help you report on-time rent payments, contributing positively to your credit score.

Each of these alternatives can effectively help you build a solid credit history.

To conclude, secured credit cards are effective tools for building credit, especially for those new to credit or looking to improve their scores. By understanding how they work and managing them responsibly, you can establish a positive credit history. Remember, timely payments and low utilization are key to enhancing your credit score. While secured cards are beneficial, consider exploring other options as well, ensuring you choose the best path for your financial journey.

You can elevate your travel experiences with rewards credit cards, but are you maximizing their full potential? Discover how to unlock incredible benefits.

I discovered that low interest credit cards for balance transfers can drastically reduce my debt, but what other benefits might they offer?

Wondering how to maximize your rewards with cash back credit cards? Discover essential tips to find the best card for your spending habits.

Pick the right credit card type to build your credit wisely; discover the best options for beginners and secure your financial future.