What Are Top Strategies to Cut Credit Card Debt?

Get ready to discover powerful strategies to cut credit card debt and transform your financial future—your path to freedom starts here!

You have several options for managing your credit card debt. Start by creating a budget that outlines your income and expenses. Consider using the Debt Snowball Method to pay off small debts first, which can motivate you to tackle larger ones. Balance transfer credit cards can help reduce interest costs. Consolidation loans may simplify multiple payments into one, often with lower interest rates. You can also seek assistance from credit counseling services for tailored repayment plans. Finally, negotiating with creditors can lead to lower rates or settlements. Each approach can contribute to a more secure financial future. Further insights are available.

Credit card debt can quickly pile up if you’re not careful, often turning into a financial burden that feels overwhelming. Understanding how this debt works is vital for effective personal finance management. Your credit score, which reflects your credit utilization and repayment history, can be directly impacted by high credit card balances and missed payments.

Interest rates on credit cards vary greatly, and accumulating interest can make it harder to pay off your debt. This is where financial literacy comes into play; knowing how to navigate loan terms and interest rates empowers you to make informed choices. Developing solid repayment strategies is essential to avoid spiraling debt.

Additionally, evaluating your spending habits can help you identify areas where you can cut back, freeing up funds to tackle your debt. Establishing emergency funds is also important; these can prevent reliance on credit cards during unexpected financial challenges.

Ultimately, setting clear financial goals allows you to prioritize paying down debt while maintaining a healthy balance in your overall financial picture. By understanding these aspects, you can take charge of your credit card debt and work towards a more secure financial future.

Managing your debt effectively is essential for maintaining financial stability and achieving long-term goals. By increasing your financial literacy, you gain the tools needed to understand and navigate your debt. Being debt-aware allows you to recognize the impact of high interest rates on your finances, helping you make informed decisions about repayment strategies.

Adopting sound budgeting strategies is fundamental in reshaping your spending habits. By tracking your expenses, you can identify areas where you can cut back, allowing you to allocate more funds toward debt repayment.

Additionally, building emergency funds is important. These funds act as a safety net, preventing you from relying on credit cards in case of unexpected expenses.

Effective financial planning also involves setting clear savings goals. When you prioritize these goals alongside debt management, you create a balanced approach to your finances.

With a structured plan, you can tackle your debts while also working towards future aspirations. Ultimately, the importance of debt management lies in its ability to enhance your overall financial well-being, ensuring you’re prepared for both current challenges and future opportunities.

A well-structured budget is your roadmap to financial success, helping you track your income and expenses effectively. To create one, start by listing all your sources of income, including your salary and any side hustles.

Next, document your monthly expenses, such as rent, utilities, groceries, and, importantly, credit card payments. This exercise will give you a clear picture of where your money goes.

You can enhance your budgeting process using various budgeting tools available online. These tools often provide templates or apps that simplify expense tracking, making it easier to monitor your spending habits.

Consider setting limits for each category of expenses and adjusting them as necessary to stay on track.

Once you’ve established your budget, review it regularly to identify areas for improvement. If you notice certain expenses are consistently higher than planned, you can make informed adjustments to avoid overspending.

After you’ve set a solid budget, it’s time to tackle your debt strategically. One effective method is the Debt Snowball Method, a popular approach among various debt repayment strategies. This method focuses on paying off your smallest debts first, regardless of interest rates.

Start by listing all your debts from smallest to largest. Make minimum payments on all but the smallest debt, directing any extra funds toward that debt. Once it’s paid off, you’ll gain momentum and can move on to the next smallest debt.

This strategy not only helps you eliminate debts but also boosts your motivation, which is essential for financial goal setting. Each time you pay off a debt, you’ll feel a sense of accomplishment, encouraging you to continue tackling larger debts.

As your confidence grows, so does your ability to manage more significant financial obligations. The Debt Snowball Method emphasizes the psychological benefits of debt repayment, making it an appealing choice for many.

If you’re feeling overwhelmed by high-interest credit card debt, balance transfer credit cards can be a smart way to lighten your financial load. These cards often come with promotional offers that allow you to transfer existing balances at low or even 0% interest for an introductory period.

The balance transfer benefits can include significant savings on interest, helping you pay down your debt faster.

However, be mindful of balance transfer fees, which typically range from 3% to 5% of the transferred amount. It’s important to assess your balance transfer limits, as they may restrict how much you can transfer.

Implementing effective balance transfer strategies, like transferring high-interest debt first, can maximize your savings.

While the balance transfer impact can be positive, be aware of the balance transfer pitfalls. Missing payments or exceeding your credit limit can lead to higher interest rates.

Before applying, check your balance transfer eligibility, as not all applicants qualify for the best offers. By understanding these factors, you can make informed decisions that support your journey toward financial freedom.

When you’re considering how to manage your credit card debt, debt consolidation loans can offer a practical solution.

These loans combine multiple debts into one, often resulting in lower monthly payments and interest rates. Understanding the benefits, types of loans available, and the application process can help you make an informed decision about whether this option is right for you.

By opting for debt consolidation loans, you can simplify your financial life and potentially save money in the long run.

These loans allow you to combine multiple high-interest debts into a single, lower-interest loan. This means you’ll have just one monthly payment to manage, making it easier to keep track of your finances.

Additionally, consolidating your debts can lead to significant debt relief. When you lower your interest rates, more of your payment goes toward the principal balance, helping you pay off your debt faster.

Over time, this can lead to substantial savings, freeing up your budget for other essential expenses or even savings goals.

Moreover, achieving financial freedom becomes more attainable through consolidation. With one manageable payment, you reduce the stress of multiple due dates and late fees.

As you make consistent payments toward your consolidated loan, you’ll see your debt decrease, which can boost your credit score over time.

Ultimately, debt consolidation loans offer a practical solution for those looking to regain control of their finances, streamline payments, and work toward a debt-free future.

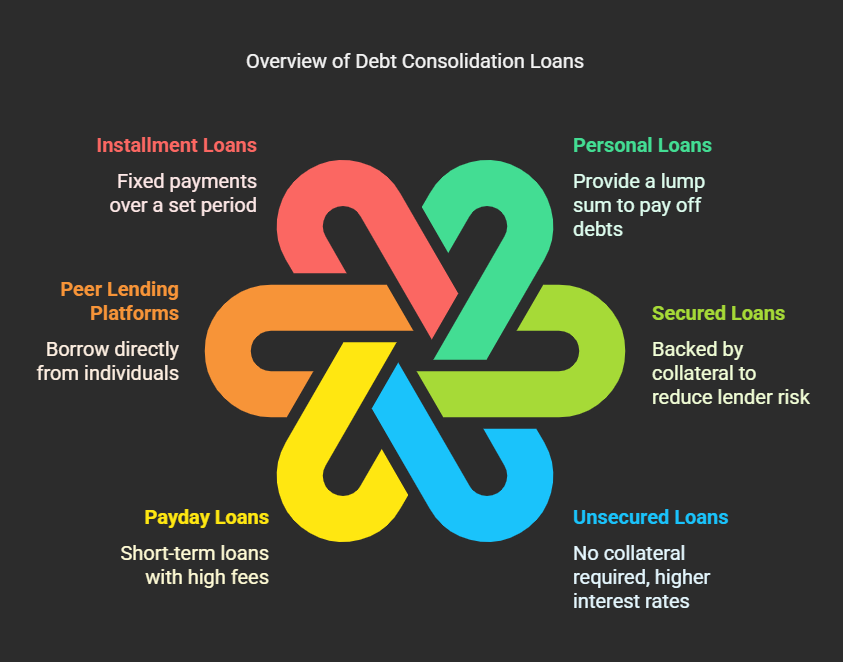

Exploring different types of debt consolidation loans can help you find the option that best fits your financial situation. One popular choice is personal loans, which can provide you with a lump sum to pay off various debts. You can choose between secured loans, which are backed by collateral, or unsecured loans, which don’t require any collateral but may come with higher interest rates.

Another option is payday loans, though they often carry high fees and should be approached with caution. Peer lending platforms can also be beneficial, allowing you to borrow directly from individuals instead of traditional financial institutions.

Installment loans offer fixed payments over a set period, making budgeting easier. Microloans can be a great resource for smaller amounts, typically offered by non-profits or community organizations.

If you’re a student, consider student loans tailored to your educational expenses, which may come with flexible repayment options. Each of these loan types has its pros and cons, so it’s essential to assess your financial situation and needs before making a decision.

Applying for a debt consolidation loan can feel intimidating, but understanding the process simplifies it considerably. To start, you’ll need to meet specific eligibility criteria, which usually include a minimum credit score and a certain debt-to-income ratio.

Next, familiarize yourself with the application requirements, as lenders typically ask for detailed financial information.

When you’re ready, gather all required documents, including proof of income, tax returns, and details of your existing debts. This will streamline the process and help you avoid delays.

The application timeline can vary by lender; some may provide a decision within a few days, while others might take a couple of weeks.

Once you submit your application, the approval process begins. Lenders will review your financial history and assess your ability to repay the loan.

Be aware of potential fees, such as origination or application fees, which can impact your overall costs. Understanding these elements will empower you to navigate the application process with confidence, ensuring you make informed decisions as you work towards consolidating your debt effectively.

Credit counseling services offer guidance and support to help you manage your credit card debt more effectively.

By working with a certified credit counselor, you can gain a better understanding of your financial situation and explore tailored strategies for repayment.

These services often provide valuable resources and education that empower you to make informed decisions about your finances.

When facing overwhelming credit card debt, understanding credit counseling services can be a game changer. Credit counseling involves working with a trained professional, known as a credit counselor. These counselors play key roles in your financial recovery, helping you navigate your debt situation effectively.

They begin with a thorough credit report analysis, identifying your debts, interest rates, and payment history. This information is essential for developing tailored solutions.

In addition to analyzing your credit report, credit counselors provide valuable financial literacy education. They teach you about interest rates, credit scores, and the long-term effects of debt, empowering you to make informed decisions about your finances.

Moreover, they help you create budgeting strategies that fit your lifestyle and goals. By learning to budget effectively, you can manage your expenses, save for future needs, and make regular payments toward your debt.

Ultimately, credit counseling services provide a structured approach to overcoming credit card debt. By collaborating with a credit counselor, you gain insights and tools that can lead to financial stability, allowing you to regain control over your financial future.

Working with a credit counseling service offers numerous benefits that can greatly impact your journey toward financial recovery. One of the primary advantages is access to financial education.

These counseling services provide you with valuable resources and information to help you understand your finances better. You’ll learn how to budget, manage expenses, and make informed decisions regarding your debt.

Additionally, credit counseling can lead to significant debt relief. Counselors can negotiate with creditors on your behalf, often resulting in lower interest rates or more manageable payment plans.

This means you might be able to pay off your debt more quickly and efficiently.

Moreover, working with a credit counselor can also help you create a personalized plan tailored to your financial situation.

This structured approach not only keeps you organized but also provides motivation as you see progress toward your goals.

Negotiating with creditors can be a strategic way to alleviate your credit card debt burden. When you reach out to them, you open the door to potential debt settlement options.

Start by evaluating your financial situation and determining what you can realistically afford to pay. This preparation will help you communicate effectively with your creditors.

During creditor communication, be honest about your situation. Explain why you’re struggling and express your willingness to pay off your debt, even if it’s less than the total amount owed.

Creditors often appreciate transparency and might be willing to negotiate terms. Discuss options such as lower interest rates, extended payment periods, or reduced settlements that could ease your financial strain.

It’s important to stay calm and professional during these conversations. Keep records of all communications and agreements, as this documentation may prove useful later.

Avoiding common pitfalls in credit card debt management is essential for maintaining financial stability. One major pitfall is emotional spending, where you use credit cards to cope with stress or negative feelings. Being aware of your debt triggers can help you resist this urge.

Focus on improving your financial literacy; understanding interest rates and credit utilization can empower you to make better decisions.

Developing effective repayment strategies is important. Prioritize high-interest debts to reduce overall costs and consider lifestyle changes that align with your financial goals, such as creating a budget or cutting unnecessary expenses.

Engaging in stress management techniques can also help you stay focused on your debt repayment plan without succumbing to emotional spending.

It’s beneficial to enlist accountability partners to support you in your journey. Sharing your goals with someone you trust can keep you motivated and on track.

Managing credit card debt effectively is vital for your financial health. By understanding your options—like creating a budget, utilizing the debt snowball method, or exploring balance transfer credit cards—you can take control of your situation. Consider debt consolidation loans or credit counseling services if necessary. Remember to communicate with your creditors and stay aware of common pitfalls. With informed decisions and a structured plan, you can navigate your debt and work towards a more secure financial future.

Get ready to discover powerful strategies to cut credit card debt and transform your financial future—your path to freedom starts here!

To tackle credit card debt effectively, discover essential steps that will transform your financial health and lead you toward a debt-free life.