What Are the Top Cards for Low Scores?

What are the top cards for low scores that can help rebuild your credit? Discover your best options today!

Credit scores matter for approval because they help lenders assess your creditworthiness. They range from 300 to 850, with higher scores increasing your chances of approval. Lenders consider factors like payment history, credit utilization, and account age when reviewing your score. A strong score can lead to better terms, like lower interest rates, while a low score may result in denial or higher rates. Understanding your credit score allows you to make informed financial decisions and improve your chances of securing credit. By exploring further, you can discover effective strategies to enhance your credit score even more.

Your credit score plays an essential role in determining your financial options. Understanding credit scores is vital for making informed decisions about loans and credit cards. Credit score basics indicate that scores typically range from 300 to 850. A higher score suggests responsible credit management, while a lower score may limit your borrowing ability.

Many people fall victim to credit score myths. For instance, some believe checking their own credit score will lower it, which isn’t true. In fact, monitoring your score can help you understand where you stand and identify areas for improvement.

Another common myth is that closing old accounts will boost your score; however, this can actually hurt your score by reducing your credit history length. Additionally, some think that paying off a debt will instantly raise their score. While paying off debt is beneficial, scores adjust based on various factors over time.

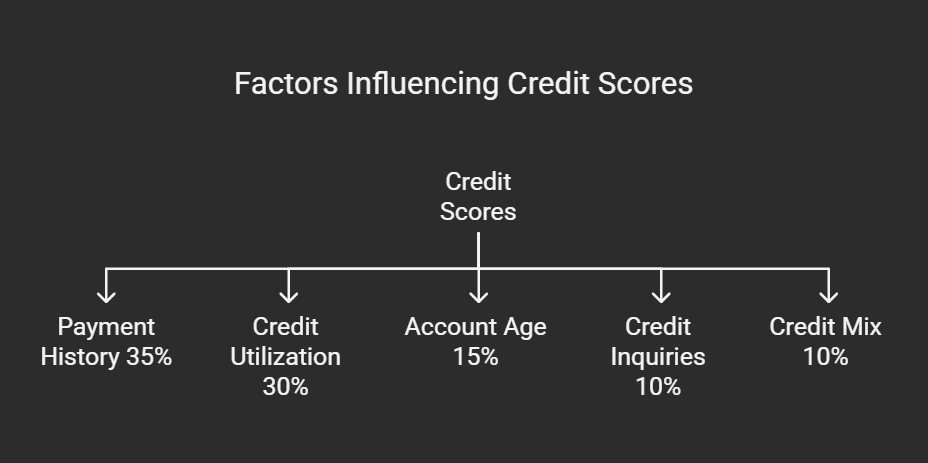

Several key factors influence credit scores, and understanding them can greatly impact your financial health. The most significant factor is payment history, which accounts for about 35% of your score. Timely payments show lenders you can manage debt responsibly.

Next is credit utilization, which represents about 30% of your score. Keeping your credit card balances low relative to your credit limit is essential; ideally, you should aim for a utilization rate under 30%.

Account age also plays a role, making up about 15% of your score. Older accounts demonstrate stability, so it’s beneficial to maintain long-standing credit lines.

Additionally, credit inquiries can affect your score; hard inquiries occur when you apply for new credit and can temporarily lower your score. They typically account for about 10% of your overall score.

Lastly, your credit mix, which consists of various types of credit accounts like credit cards, mortgages, and auto loans, influences about 10% of your score. A diverse credit mix can enhance your score, demonstrating your ability to manage different types of credit responsibly.

Understanding how credit scores work is vital when it comes to credit card approval. Your credit score plays a key role in determining your credit card eligibility. Lenders use this score to assess the risk associated with granting you credit. A higher score usually means you’re more likely to get approved, while a lower score can lead to denial or higher interest rates.

During the application process, lenders evaluate your credit history, which includes your payment history, amounts owed, length of credit history, and types of credit used. They want to see that you’ve managed credit responsibly over time.

If your score falls within the lender’s desired range, you’re more likely to receive favorable terms on your credit card, including lower interest rates and higher credit limits.

Conversely, if your credit score is low, you might face challenges. Many lenders set minimum score requirements, and failing to meet these can limit your options considerably.

As a result, knowing your credit score and understanding its impact on credit card eligibility can empower you to make informed financial decisions. It’s essential to stay proactive about your credit health to improve your chances of successful card applications in the future.

To boost your credit score effectively, start by reviewing your credit report for errors. Mistakes can negatively impact your score, so dispute any inaccuracies you find.

Next, focus on your payment history; consistently paying your bills on time is essential. Late payments can greatly lower your score, so set reminders or automate payments to guarantee you never miss a due date.

You should also monitor your credit utilization, which is the ratio of your credit card balances to their limits. Aim to keep this ratio below 30% to demonstrate responsible credit management.

Additionally, be cautious with credit inquiries; each time you apply for new credit, it can slightly decrease your score.

Incorporate good debt management practices, such as paying down existing debts and maintaining a balanced credit mix, which includes different types of credit accounts. This variety shows lenders that you can handle multiple forms of credit responsibly.

If your credit score isn’t where you want it to be, don’t despair—there are still options available to you. One potential route is to evaluate credit unions, which often provide loans and credit products with more lenient approval requirements.

Another option is secured credit cards, where you deposit money as collateral. This can improve your payment history and enhance your credit score over time.

Peer lending platforms also present an alternative financing option. These platforms connect borrowers with individual investors who may be willing to lend despite your low credit score.

Additionally, using a co-signer can greatly increase your chances of approval. A co-signer with a stronger credit profile agrees to take responsibility for the loan, easing the lender’s concerns.

It’s essential to remember that while these options can help you secure financing, maintaining responsible payment habits is vital. Always make your payments on time to positively impact your credit score.

In summary, credit scores play an essential role in determining your eligibility for loans and credit cards. By understanding the factors that influence these scores, you can take steps to improve your financial standing. If your credit score is low, exploring alternative options can still help you secure credit. Ultimately, being informed about your credit score empowers you to make better financial decisions and enhances your chances of approval for future credit opportunities.

What are the top cards for low scores that can help rebuild your credit? Discover your best options today!

You might be surprised to learn how credit utilization affects loan approvals—discover the key factors that lenders consider.

For better credit card offers and lower interest rates, enhancing your credit score is crucial; discover how to make it work for you.

Discover the importance of understanding credit score requirements for cards and how it can unlock better financial opportunities for you. What will you learn next?