3 Tips for Comparing Auto Loan Types and Rates

Just discover essential tips for comparing auto loan types and rates that can save you money—your ideal financing awaits!

Understanding different types of personal loans is vital for effective financial management. Personal loans generally fall into two categories: secured and unsecured. Secured loans require collateral, typically resulting in lower interest rates, while unsecured loans do not, often leading to higher rates due to perceived lender risk. Common uses for personal loans include debt consolidation, home improvements, and medical expenses. Monthly payments are predictable, aiding in budgeting, but high-interest rates can pose risks. Additionally, avoiding loans with extremely high rates is essential for maintaining financial stability. To gain a deeper insight, consider the unique characteristics and implications of each loan type.

Personal loans are a popular financial solution, with approximately 20% of American adults utilizing these products for various needs. These versatile financial tools can be categorized into two main types: unsecured personal loans, which do not require collateral, and secured personal loans, which are backed by an asset. The distinction between these types markedly influences the interest rates and approval criteria.

As of 2023, the average interest rate for personal loans ranges from 10% to 12%, although individuals with excellent credit may secure rates below 7%. Unsecured personal loans typically carry higher interest rates, often ranging from 6% to 36%, as they are assessed based on the borrower’s credit score, income, and existing debt load.

Personal loans include various uses, such as debt consolidation loans, home improvements, medical expenses, and major purchases, providing borrowers with flexibility in fund allocation.

The loan application process usually begins with prequalification, allowing potential borrowers to estimate their rates without impacting their credit scores. Following approval, funding is typically available within 1 to 7 business days, making personal loans a timely option for those in need of financial assistance.

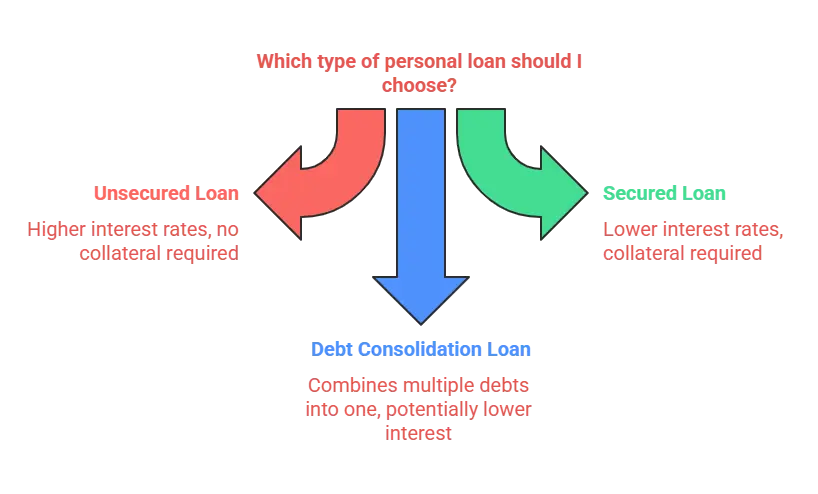

When considering types of personal loans, it is crucial to understand the differences between unsecured and secured loans, as well as options for debt consolidation.

Unsecured loans do not require collateral and typically come with higher interest rates, while secured loans involve collateral and generally offer lower rates but carry the risk of asset loss.

Additionally, debt consolidation loans can simplify financial management by combining multiple debts into a single loan, potentially reducing interest costs and making payments more manageable.

Traversing the landscape of personal loans requires an understanding of the key differences between unsecured and secured loans. Unsecured loans do not require collateral, making them riskier for lenders, which typically results in higher interest rates ranging from 6% to 36%, contingent on the borrower’s creditworthiness.

The approval process for these loans heavily relies on the borrower’s credit score and income, granting flexibility for various expenses but often limiting access for those with lower credit scores.

In contrast, secured loans require collateral, such as a vehicle or savings account. This backing generally leads to lower interest rates compared to unsecured loans. However, it carries the risk of losing the asset if payments are not made.

Additionally, secured loans can offer repayment terms that extend beyond those of unsecured loans, which usually range from 2 to 7 years. Because secured loans reduce lender risk, they may provide more favorable terms even for borrowers with less-than-ideal credit scores.

Understanding these distinctions is essential for individuals seeking personal loans, as the choice between unsecured and secured options can greatly impact financial outcomes.

A variety of debt consolidation options are available to borrowers seeking to manage multiple high-interest debts effectively. A debt consolidation loan allows individuals to combine their existing debt into a single loan, often with lower interest rates compared to individual credit cards. This can result in substantial savings over time, particularly for those struggling with high monthly payments.

Debt consolidation loans can be categorized as either secured or unsecured. Unsecured loans do not require collateral, making them accessible; however, they may come with higher interest rates. In contrast, secured loans typically offer lower rates in exchange for collateral. The average interest rate for these loans ranges from 6% to 36%, influenced by factors such as the borrower’s credit score, income, and existing debt.

Utilizing a debt consolidation loan simplifies financial planning by converting multiple payments into a single fixed monthly payment. This can aid borrowers in managing their finances more effectively.

Additionally, consistent on-time payments can help improve your financial standing by positively impacting your credit score and reducing overall credit utilization, contributing to better long-term financial health.

Personal loans offer several key benefits that can greatly enhance financial management.

With predictable monthly payments, borrowers can effectively budget their expenses, while responsible use of these loans can lead to an improved credit score.

Additionally, personal loans provide quick access to funds, making them a viable option for addressing urgent financial needs.

Many borrowers find the predictability of monthly payments offered by personal loans to be one of their most appealing features. Personal loans typically come with fixed monthly payments, allowing borrowers to budget effectively without worrying about fluctuations. This stability is largely due to the fixed interest rates associated with these loans, which means that the personal loan interest remains constant throughout the loan term.

Borrowers can expect to repay the loan over a period ranging from 2 to 7 years, making it manageable to incorporate into their monthly expenses. With a clear understanding of the annual percentage rate, borrowers can compare different types of personal loans and choose one that aligns with their financial situation.

Additionally, having predictable monthly payments can positively impact a borrower’s credit history, especially when payments are made on time. This consistency is advantageous compared to variable-rate loans, which can change based on market conditions, creating uncertainty in budgeting.

Ultimately, the reputation of lenders also plays a role in ensuring that borrowers receive favorable terms, such as lower interest rates, further enhancing the benefits of predictable monthly payments in personal loans.

Boosting your credit score can be achieved through responsible management of personal loans. By making timely payments, you can positively influence your payment history, which constitutes about 35% of your credit score. Consistently repaying a personal loan not only helps improve your credit score but also diversifies your credit mix, accounting for approximately 10% of your overall credit profile.

Another effective strategy is utilizing personal loans for debt consolidation. This approach can greatly lower your credit utilization ratio, a critical factor in credit scoring, as it enables you to pay off high-interest credit card debt and reduce outstanding balances.

By managing your loan payments responsibly, you can maintain a low debt-to-income ratio, demonstrating to lenders that you are a responsible borrower.

The average personal loan debt stands around $19,402. If handled appropriately, this debt can enhance your credit score over time, showcasing your ability to manage various types of credit effectively.

The convenience of quick access to funds makes personal loans an attractive option for those facing urgent financial needs. With approval times ranging from mere minutes to several days, borrowers can typically expect disbursement within 1-7 business days after approval.

Personal loans accommodate a wide array of financial needs, offering loan amounts generally between $1,000 and $100,000, enabling individuals to address immediate concerns efficiently.

The average interest rate for personal loans in 2023 is approximately 10-12%, which often proves to be lower than credit card rates, making personal loans a cost-effective solution for urgent financing. Additionally, the fixed monthly payments associated with personal loans contribute to budgeting predictability, allowing borrowers to manage their finances with greater ease.

These loans offer flexibility, permitting individuals to use the funds for various urgent purposes such as medical expenses or home repairs. This adaptability is essential in times of financial strain, as it empowers borrowers to tackle pressing issues without the burden of excessive debt.

Personal loans can offer immediate financial relief, but they also carry significant risks that borrowers must consider. One of the primary concerns is the high interest rates associated with unsecured personal loans, which can range from 6% to 36%, depending on the borrower’s credit score. Such rates can dramatically increase the total debt burden, making repayment challenging.

Over-borrowing is another prevalent issue, as the average consumer personal loan debt stands at approximately $19,402. Borrowers may find themselves in a precarious financial situation if they exceed their means.

Misunderstanding loan terms, including fees and penalties for late payments, can lead to unexpected financial obligations and exacerbate existing debt problems.

Additionally, failing to repay personal loans can damage a borrower’s credit score, resulting in long-term implications for future borrowing opportunities. This deterioration may increase the cost of credit for future loans, making it even more difficult to manage finances.

Ultimately, irresponsible use of personal loans can lead to a debt cycle, where borrowers rely on additional loans to cover existing debts, perpetuating financial strain and complicating their overall financial situation.

Maneuvering the landscape of loans can be intimidating, especially when it comes to identifying which types to avoid. Among the most concerning are payday loans, which often feature exorbitant interest rates that can soar up to 400% APR, trapping borrowers in cycles of debt that are challenging to escape.

Title loans, secured by the borrower’s vehicle, present a significant risk; failure to repay can result in losing the car, with monthly interest rates averaging 25%. High-interest unsecured loans, with APRs ranging from 20% to 36%, can lead to unmanageable debt levels, often exceeding those of standard credit cards.

Predatory loans are particularly harmful, characterized by exploitative terms and conditions designed to ensnare vulnerable borrowers. These loans frequently include hidden fees and high-interest rates that compound financial difficulties.

Additionally, loans with prepayment penalties discourage responsible financial behavior by imposing extra charges for paying off debt early. Understanding these pitfalls is essential for consumers to make informed financial decisions and safeguard their financial well-being, avoiding loans that could lead to detrimental outcomes.

Considering the financial landscape, several alternatives to personal loans can provide individuals with viable options for managing their expenses without incurring excessive debt.

Credit cards are suitable for smaller, short-term needs, but they often come with higher interest rates, averaging around 21.19% as of Q3 2023. For those looking to borrow larger amounts, home equity loans offer low interest rates, typically around 5.82% for a 15-year fixed-rate loan, although they carry the risk of foreclosure if repayments fail.

Individuals might also consider 0% APR Introductory Credit Card Offers for balance transfers, allowing them to manage existing debt without additional interest during the promotional period.

Borrowing from friends or family can provide no-interest loans, but it is essential to establish clear repayment terms to avoid straining personal relationships.

Additionally, government assistance programs offer financial support without the burden of repayment, making them a viable alternative for those in specific need.

In conclusion, personal loans serve various purposes and come in multiple forms, each with distinct advantages and potential drawbacks. Understanding the types of personal loans, their benefits, and associated risks is essential for informed decision-making. While some loans may be beneficial, others should be approached with caution or avoided entirely. Exploring alternatives can also provide viable financial solutions. A thorough understanding of personal loans equips individuals to navigate their financial options more effectively.

Just discover essential tips for comparing auto loan types and rates that can save you money—your ideal financing awaits!

Just when you thought getting a personal loan with bad credit was impossible, discover five surprising options that could change your financial future.

Browse the various types of graduate school student loans available, but which one is right for you? Discover the details inside.

Home improvement loans come in secured and unsecured forms; discover which option could impact your finances and projects the most.

Unlock the secrets to the 7 best mortgage options for first-time buyers and discover which one could be your perfect fit!